The perverse incentive for the high costs of medical devices and delay to market

The CRO outsourcing model and high US hospital prices result in higher total CRO profits via higher costs to companies developing innovative medical devices. These costs are passed down to consumers after FDA clearance.

We’ll take a look at the cost dynamics of medical device clinical trials and the clinical trial value chain.

We’ll then consider an alternative business model that changes the way medical device sponsors conduct clinical trials, reduce their costs by 70-80% and shortens time to FDA submission.

The high costs of US hospitals

By 2000, the US spent more on healthcare than any other country, whether measured per capita or a percentage of GDP.

U.S. per capita health spending was $4,631 in 2000, an increase of 6.3 percent over 1999. 4 The U.S. level was 44 percent higher than Switzerland’s, the country with the next-highest expenditure per capita; 83 percent higher than neighboring Canada; and 134 percent higher than the OECD median of $1,983. 5

In 2011, the US Affordable Care Act set a requirement for MLR (Medical Loss Ratio) that insurers must spend 80-85% of revenue on medical services. This reduced insurer margins, and drove up hospital prices to make up for lower margin.

The CRO business model

CROS (clinical research organizations) are outsourcing businesses that provide an array of services for clinical trial management and monitoring, reporting and regulatory submission. For medical device studies, CROS employ 2 basic outsourcing models, people sourcing and functional sourcing. In people out-sourcing, the medical device company is responsible for managing contractors. In functional outsourcing, the company may buy a set of functions, for example study monitoring and medical writing.

Neither CRO model has an explicit incentive to complete a study faster since that would reduce outsourcing revenue for the CRO. The more time a CRO spends on monitoring, site visits, SDV and study closeout, the more revenue it generates.

A medical device sponsor may elect to do it himself which shifts the CRO cost to an internal headcount cost supplemented with additional costs for consultants with risk and time delays by not having the CRO expertise and infrastructure. There is tacitly no free lunch, as we will discuss later in this article.

The result is a perverse incentive for delay and higher costs to bring innovative medical devices to market.

The CRO business model combined with higher hospital prices drive higher total profits via higher costs to customers. The higher cost of innovative medical devices is then passed down to consumers (patients) after FDA clearance.

Consumer value chains

A consumer value chain looks generically like this:

Suppliers -> Distributers -> Consumers

By the early 90’s, the PC industry led by Intel and Microsoft used a 2-tier value chain:

MSFT->Distis->Resellers->Customers.

Resellers were further segmented according the customer size and industry segment – Retail, Large accounts, SMB and VARS (value-added-resellers) selling their own products and services to a particular industry vertical. The PC industry value-chain model left Microsoft with 50% of the SRP (suggested retail price) and delivered products to customers that were 45-50% less than SRP, leaving the channel with 0-5%.

The channel was forced to implement extremely efficient operations and systems and sell value-added services and products in order to survive.

By the new millennium, Apple introduced a 1-tier model with a user-experience designed and controlled by Apple.

The Apple 1-tier channel looks like this:

Apple->Apple Stores->Consumers

Eventually the Apple channel model broadened to include a 2-tier model similar to PC industry:

Apple->Distis->Retail->Consumers

By the mid-2000s, Amazon AWS (and generally the entire cloud service / SaaS industry) evolved the channel model to 0-tiers with a direct subscription and delivery model.

AWS->Consumers

As AWS grew and introduced spot pricing, an aggregation sub-market developed, looking extremely similar to movie and TV distribution models.

AWS->Aggregators->Consumers

AWS also became a distribution channel for other cloud products similar to content distribution (Think Netflix).

Third-party products->AWS->Consumers

Outstanding user-experience and aggregation are the hallmarks of companies like Airbnb, Netflix and Uber.

The common thread is that AWS and Netflix deliver a digital product end-to-end, whereas Airbnb and Uber aggregate trusted suppliers inside the Airbnb and Uber brand environment and provide an outstanding and uniform user experience to all the consumers. This is in contrast to the variegate user experience a customer got from the 90’s Microsoft channel. There are great resellers and terrible resellers.

We will return to user experience and aggregation later.

The medical device clinical trial value chain

The first published RCT (randomized clinical trial) in medicine appeared in the 1948 paper entitled Streptomycin treatment of pulmonary tuberculosis.

The clinical trial value chain for medical devices looks strange once after the historical perspective of how Intel, Microsoft, Amazon and Netflix evolved their value chains.

The medical device clinical trial value chain has 3 tiers with patients that are both suppliers and consumers.

Patients->Hospitals->CROS->Medical device companies->Patients

A dystopian user experience

Little has changed in the past 71 years regarding clinical trials. Clinical trials and hospital operations now have a plethora of complex expensive, difficult-to-use IT with a value chain that provides a dystopian user experience for hospitals, patients and medical device companies.

HCOs (healthcare operators) rely on data collection technology procured by companies running clinical research (sponsors and CROs). This creates a number of inefficiencies:

1 – HCO staff are faced with a variety of systems on a study by study basis. This results in a large amount of time spent learning new systems, staff frustration and increased mistakes. This is passed on in costs and time to sponsors after CRO markup.

2 – The industry is trending towards the use of eSource and EMR to EDC data transfer. eSource/ePRO tools need to be integrated into the patient care process. Integration of EMR with EDC becomes logistically difficult due to the number of EDC vendors on the market (around 50 established companies).

3 – Siloed data collection in hospitals with subsequent manual data re-entry results in large monitoring budgets for Source Data Verification, and delays caused by data entry errors and related query resolution. Delays can be on the order of weeks and months.

4 – Use of multiple disconnected clinical systems in the hospital creates a threat surface of vendor risk, interface vulnerabilities and regulatory exposure.

Losing focus on patients

One of the consequences of the 3-tier medical device value chain is loss of focus on the patient user experience. Upstream and to the left, patients are ‘subjects’ of the trial. The patient reported outcomes apps they use vary from study to study. Downstream and to the right (what FDA calls ‘post-marketing’), patients are consumers of the medical device and the real-world user experience is totally different than the UX in the study. The real-world data of device efficacy and safety is disconnected from the clinical trial data of device efficacy and safety.

Clinical trial validation

Patient compliance is critical to clinical trial validation of medical device. Who owns patient compliance to the research protocol? The medical device sponsor, the CRO, the hospital site or the subject? The CRO may not collect a patient compliance metric since he outsources to the hospital. The hospital may not have the tools and the medical device company is outside the loop. My essay on determining when patient compliance is important in medical device trials goes into more detail on the problem of losing focus on the patient.

Vertical integration and aggregation

We previously made a qualitative claim that hospital site costs are high for medical device studies. How high are they relative to consumer healthcare?

In a medical device trial recently done on the Flaskdata.io platform, the sponsor paid the hospital investigatory sites $700K for a 100 subject, 7 month multi-site study. (There were no medical imaging and blood test requirements).

In 2016, Medicare Advantage primary care spend was $83 PMPM (per member per month). Let’s say that a premium service should cost $100 PMPM. Let’s use that as a benchmark for the cost of processing a patient in a medical device trial. Take this medical device Phase II medical device trial with 100 patients, running for 7 months:

That’s 100 x 7 x 100 = $70K for patients. Not $700K.

Perhaps the law of small numbers is killing us here. The way to solve that is with aggregation and vertical integration. Let’s return to the medical device clinical trial value chain. As we can see, there are too many moving parts and a disconnect between patients in the clinical studies and consumers in the real world.

Patients->Hospitals->CROS->Medical device companies->Patients

One alternative is to integrate backwards and to the left. This requires managing hospital site functions and to a certain degree is done in the SMO (site management organization model).

The other alternative is to integrate forward and to the right. This is the path that Airbnb, Uber and Netflix took aggregating consumer demand with an outstanding user experience. The aggregation gives Airbnb, Uber and Netflix buying power to the left, enabling them to choose the best and most cost-effective suppliers.

The value chain would then look like this:

Suppliers->Medical device companies->Patients

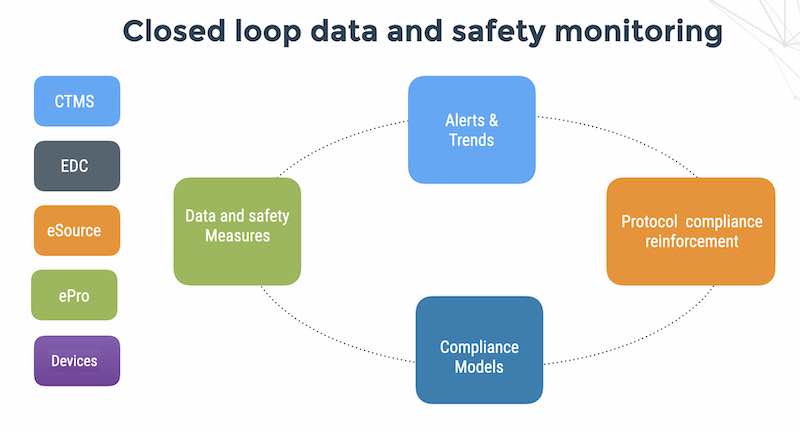

This is a model that we see increasingly with Israeli medical device vendors with limited budgets. The Medical device company uses a cloud platform to collect digital feeds from investigators, patients and devices and automate monitoring for deviations. Focus on the patient user experience begins with design of the device and continues to post-marketing. Aggregation of patients enables purchasing power with suppliers – research sites, clinical consultants and study monitors.

Short-term versus long-term cost allocation

The reality is that using a technology platform for vertical integration is more expensive initially for implementation by the medical device company. It should be.

Under-funding your infrastructure results in time delays and cost spikes to the medical device sponsor at the end of the study.

The current CRO methodology of study close-out at the end of a clinical trial lowers costs during the trial but creates an expensive catch-up process at the end of the study.

The catch-up process of identifying and closing discrepancies can take 2-6 months depending on the size and number of sites. The catch-up process is expensive, delaying submission to FDA and revenue since you have to deal with messy datasets. The rule of thumb is that it costs 100X more to fix a defect after the product is manufactured than during the manufacturing process. This is true for clinical trials as well. A real-time alert on treatment non-compliance during the study can be resolved in 5 minutes. By waiting to the end of study it will take a day of work-flow, data clarifications and emails to the PI.

Summary

Vertical integration reduces costs and delay at study-end with continuous close. It is more expensive initially for the medical device company and it should be because it accelerates time to submission and reduces monitoring and close-out costs.